Accountancy

Accountancy service refers to a professional service that provides accounting and financial management support to individuals, businesses, and organizations. Accounting services typically include tasks such as bookkeeping, financial reporting, tax preparation, and auditing. They may also provide advisory services to help clients make informed financial decisions and optimize their financial performance.

Company Registration & R.O.C Filing

Company registration and R.O.C. filing are crucial for businesses to operate legally and avoid legal complications. Companies can seek the help of professional services that specialize in these areas to ensure compliance with all legal requirements and smooth functioning of their business operations.

Incom Tax Return

Income Tax Return (ITR) service refers to a professional service that helps individuals and businesses file their income tax returns with the government. An income tax return is a document that summarizes an individual or business's income, deductions, and tax liabilities for a given tax year. The government uses this information to determine the amount of taxes owed or any refunds due. ITR services typically include preparing and filing income tax returns, providing tax planning and advisory services, and representing clients in the event of a tax audit.

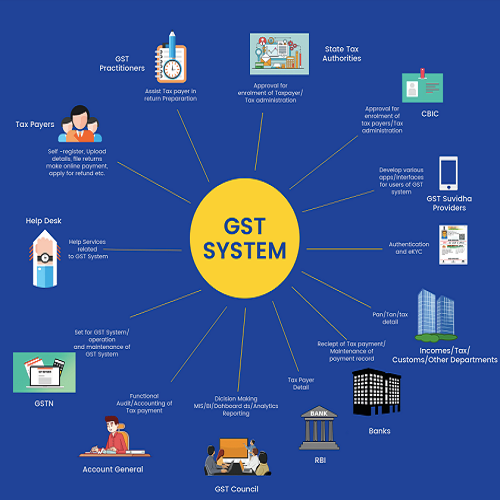

GST Registration and Return

GST (Goods and Services Tax) registration is the process of registering a business entity with the government for the purpose of collecting and remitting GST on the sale of goods and services. GST is a value-added tax that is levied on the supply of goods and services and is required for businesses that meet certain turnover thresholds.

Project Report

Project report service refers to a professional service that helps individuals, businesses, and organizations prepare and present project reports. A project report is a detailed document that outlines the objectives, scope, budget, timeline, and other aspects of a proposed project. Project reports are often required by investors, lenders, or other stakeholders to evaluate the feasibility and potential of a project.

Financial Planning

Financial planning services refer to professional services that help individuals and businesses manage their finances and achieve their financial goals. Financial planning services can include a wide range of activities, such as budgeting, investing, retirement planning, tax planning, estate planning, and risk management.

Tax Audit

Tax audit services refer to professional services that provide an independent review and assessment of a business's or individual's tax returns and compliance with tax laws and regulations. Tax audits are typically conducted by certified public accountants (CPAs) or other qualified professionals.

Trust, Society, Firm Registration

Trust, society, and firm registration services refer to professional services that help individuals and organizations establish legal entities for charitable, social, or commercial purposes.

Income Tax and GST Appeal Revision

Income tax and GST appeal revision services refer to professional services that help taxpayers appeal and revise tax assessments or decisions made by tax authorities. In the case of income tax, an appeal can be filed by a taxpayer if they disagree with a tax assessment or decision made by the tax authorities. An appeal can be filed with the Appellate Tribunal or the High Court depending on the amount of tax involved.

Political Party Registration

Political party registration is a legal requirement in most countries, and the process varies depending on the jurisdiction. In general, political party registration requires the submission of a formal application that includes information about the party's goals, objectives, and leadership. The application must also meet certain legal requirements, such as having a minimum number of members, adhering to specific party constitution and bylaws, and having a bank account.

Excise And Customs

Excise and customs services refer to professional services that provide guidance and support to businesses and individuals regarding the compliance of excise and customs laws and regulations.

FEMA

FEMA services refer to professional services that provide guidance and support to individuals and businesses regarding compliance with the Foreign Exchange Management Act (FEMA) regulations in India.

Enforcement Directorate (ED) Cases

ED cases refer to cases investigated by the Enforcement Directorate (ED) in India, which is a law enforcement agency that investigates economic offenses such as money laundering and foreign exchange violations.

RERA (Real Estate Regulatory Authority)

RERA (Real Estate Regulatory Authority) services for Chartered Accountants (CA) refer to professional services that provide guidance and support to real estate developers and promoters regarding compliance with RERA regulations in India.